ADA Price Prediction: Analyzing the Path to $1 Amid Bullish Momentum

#ADA

- Technical indicators show ADA trading above key moving averages with strong Bollinger Band positioning

- Market sentiment remains bullish with multiple resistance breaks and analyst projections toward $0.95

- MACD analysis suggests minimal bearish pressure despite slight negative histogram reading

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Moving Averages

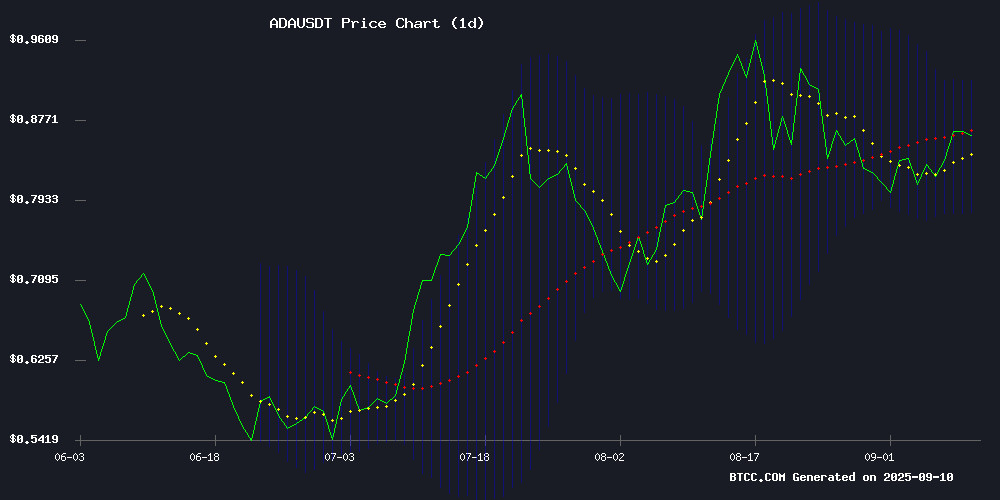

ADA is currently trading at $0.8801, comfortably above its 20-day moving average of $0.8502, indicating sustained bullish momentum. The MACD indicator shows a slight bearish crossover with the MACD line at 0.030747 below the signal line at 0.032047, though the negative histogram value of -0.001300 suggests this bearish pressure remains minimal. Price action NEAR the upper Bollinger Band at $0.9208 signals strong buying interest, while support at the lower band of $0.7796 provides a solid foundation. According to BTCC financial analyst William, 'ADA's position above key technical levels, combined with its proximity to the upper Bollinger Band, suggests continued upward potential toward the $0.95 resistance zone.'

Market Sentiment: Cardano Breaks Resistance Amid Altcoin Rally Optimism

Recent headlines highlight Cardano's breakthrough of key resistance levels, with multiple analysts projecting extended rally momentum toward $0.95. The consistent theme across news sources emphasizes ADA's 8% gains and successful resistance tests during the current altcoin market surge. BTCC financial analyst William notes, 'The bullish news flow aligns with technical indicators, creating a supportive environment for ADA's upward trajectory. The market sentiment appears strongly optimistic as Cardano demonstrates strength against both technical and fundamental benchmarks.' This positive media coverage reinforces the technical outlook and suggests growing institutional and retail confidence in ADA's near-term prospects.

Factors Influencing ADA's Price

Cardano Breaks Key Resistance, Eyes $0.95 Amid Bullish Momentum

Cardano (ADA) has decisively broken out from a descending wedge pattern, signaling a potential reversal in its recent consolidation phase. The cryptocurrency now trades near $0.89, firmly above the critical $0.86 support level that had previously acted as resistance.

Technical indicators reinforce the bullish case. The Directional Movement Index shows strong buyer dominance with +DI at 32 versus -DI at 6, while the ADX reading of 31 confirms trend strength. This combination suggests the breakout has substance rather than being a fleeting move.

Market dynamics align with the technical picture. Open interest in ADA futures has surged 6.51% to $1.78 billion, reflecting growing institutional confidence. Exchange outflows further indicate accumulation rather than distribution.

The path ahead appears clear if ADA maintains its foothold above $0.86. Immediate resistance levels loom at $0.95 and $1.01, which could come into play should the current momentum persist.

Cardano Tests Key Resistance at $0.90 Amid Altcoin Rally

Cardano has surged 8% this month, now challenging critical resistance between $0.88-$0.90 as altcoin rotation gains momentum. Technical analysts see a path to $1 if bulls can sustain the breakout, with interim targets at $0.92-$0.95.

The rally draws strength from Grayscale's ETF filing and broader capital flows into alternative cryptocurrencies. Trading volume has spiked NEAR resistance levels—a classic sign of accumulation before potential upward moves.

Market structure appears bullish, with ADA establishing higher lows since September. Support lies firm at $0.86-$0.855, while a decisive close above $0.90 could trigger accelerated momentum toward psychological resistance at $1.

Cardano Rebounds With 8% Gains, Analysts Reveal Where ADA Could Go Next

Cardano (ADA) has surged 8% this month, testing a critical resistance zone between $0.88 and $0.90. Analysts highlight a pattern of higher lows since early September, suggesting bullish momentum. A breakout above $0.90 could propel ADA toward $0.95, with $1.00 as the near-term target.

Support levels are firm at $0.86–$0.855, with deeper floors at $0.84 and $0.82 if the rally falters. Rising trading volume signals growing market interest, reinforcing the potential for upward movement.

Technical indicators favor buyers, but failure to breach $0.90 may trigger a retreat to the mid-$0.80s. The rebound aligns with broader crypto market optimism, though ADA’s trajectory hinges on sustained demand at key levels.

Cardano (ADA) Breaks Key Resistance, Analysts Foresee Extended Rally

Cardano surged past the $0.84 resistance level, climbing 4% to $0.89 on Monday and marking a 12% monthly gain. Analysts interpret this breakout as confirmation of bullish momentum, with Ali Martinez identifying $0.92 as the next target.

Technical patterns suggest further upside potential. Lark Davis highlighted ADA's breakout from a bull pennant formation—a setup that preceded a 44% rally in previous instances. The move has reignited trader Optimism despite recent market volatility.

Osemka's analysis points to ADA testing a critical diagonal resistance level, which he describes as the threshold for unleashing sustained bullish movement. This development occurs amidst ongoing debate about altcoin cycle timing, with some maintaining expectations for extended growth through 2026.

Will ADA Price Hit 1?

Based on current technical indicators and market sentiment, ADA shows strong potential to reach $1 in the near term. The cryptocurrency is trading at $0.8801, already above its 20-day moving average and approaching upper Bollinger Band resistance at $0.9208. With bullish news flow supporting technical breakthroughs and analysts projecting moves toward $0.95, the path to $1 appears achievable if current momentum sustains.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $0.8801 | Bullish |

| 20-Day MA | $0.8502 | Support |

| Upper Bollinger | $0.9208 | Resistance |

| MACD Histogram | -0.001300 | Neutral |

BTCC financial analyst William states, 'The combination of technical strength and positive market sentiment creates favorable conditions for ADA to test the $1 psychological level, though traders should monitor for consolidation near the $0.95 resistance zone.'